Renters Insurance in and around Franklin

Renters of Franklin, State Farm can cover you

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

Home Is Where Your Heart Is

Your rented house is home. Since that is where you make memories and rest, it can be a good idea to make sure you have renters insurance, even if your landlord doesn’t require it. Even for stuff like your towels, kitchen utensils, hiking shoes, etc., choosing the right coverage can make sure your stuff has protection.

Renters of Franklin, State Farm can cover you

Your belongings say p-lease and thank you to renters insurance

There's No Place Like Home

It's likely that your landlord's insurance only covers the structure of the property or home you're renting. So, if you want to protect your valuables - such as a TV, a couch or a bedding set - renters insurance is what you're looking for. State Farm agent Scott Manshack can help you examine your needs and protect yourself from the unexpected.

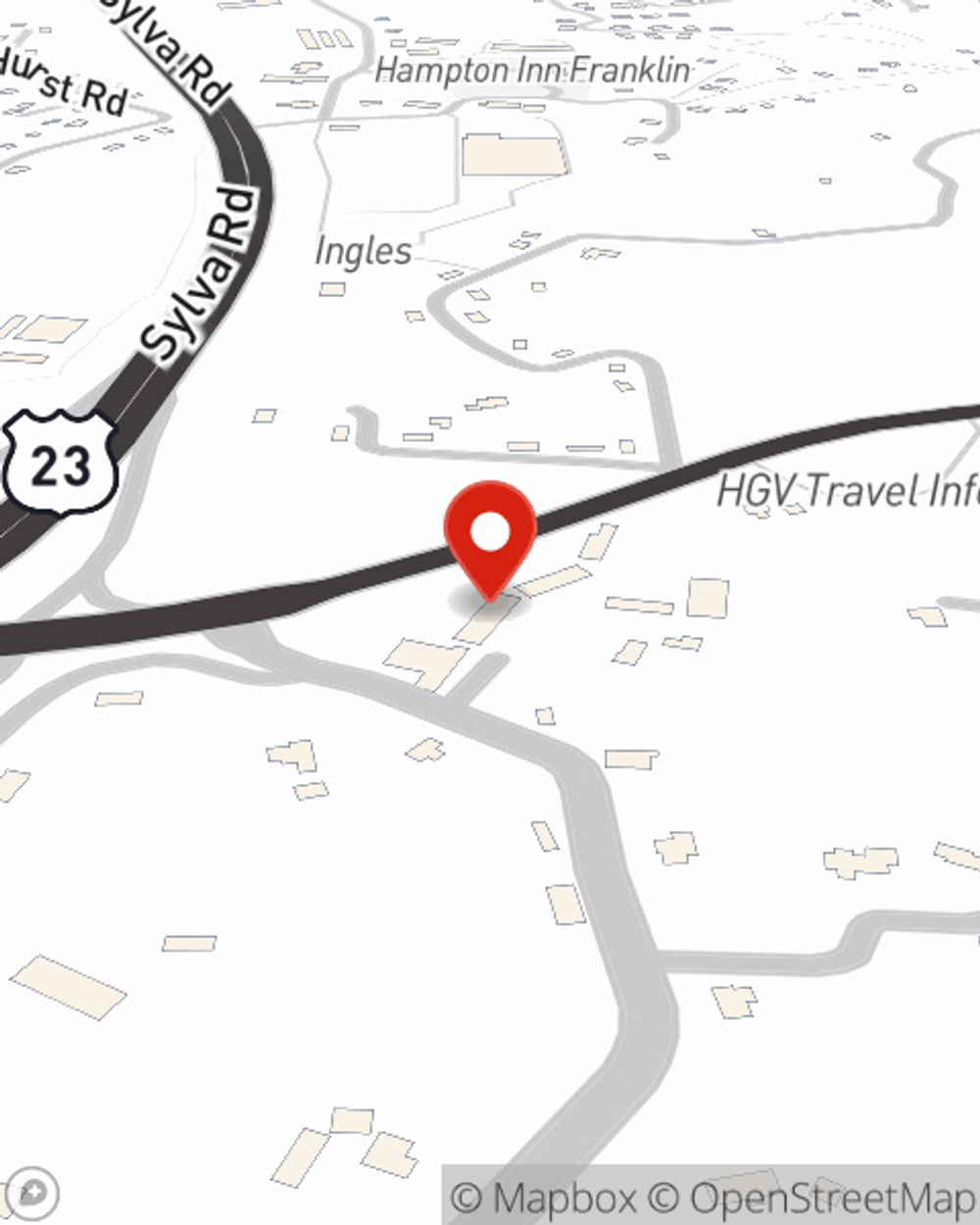

Renters of Franklin, visit Scott Manshack's office to get started with your particular options and how you can save with State Farm renters insurance.

Have More Questions About Renters Insurance?

Call Scott at (828) 524-1200 or visit our FAQ page.

Simple Insights®

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.

What to do if you can’t pay rent

What to do if you can’t pay rent

Many people may need short-term help with rent payments. Whether due to job loss or unexpected costs, these options could help.

Scott Manshack

State Farm® Insurance AgentSimple Insights®

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.

What to do if you can’t pay rent

What to do if you can’t pay rent

Many people may need short-term help with rent payments. Whether due to job loss or unexpected costs, these options could help.